Understanding how to price a business for sale is crucial for entrepreneurs looking to maximize their investment. Whether you’re planning to sell, attract investors, secure a loan, or simply strategize for future growth, knowing your business’s worth is a foundational step. This guide will walk you through the importance of business valuation, key concepts, valuation methods, and practical steps to help you determine your company’s true value.

Why Knowing Your Business Value Matters

Selling Your Business

Setting the right price is pivotal when selling your business. Overpricing can drive potential buyers away, while underpricing may leave significant money on the table. A precise valuation ensures you attract serious buyers and negotiate confidently.

Attracting Investors

Investors want to know what they’re getting into. A well-calculated business value demonstrates your company’s worth, increasing their confidence in funding your ventures and helping determine a fair investment amount.

Securing Loans

Lenders often require a professional business valuation to assess the risks involved in lending. Accurate valuation can strengthen your case when applying for loans or credit lines.

Strategic Planning

Understanding your business value enables you to evaluate financial health, identify growth opportunities, and create a roadmap for success. It’s also essential for crafting long-term exit strategies.

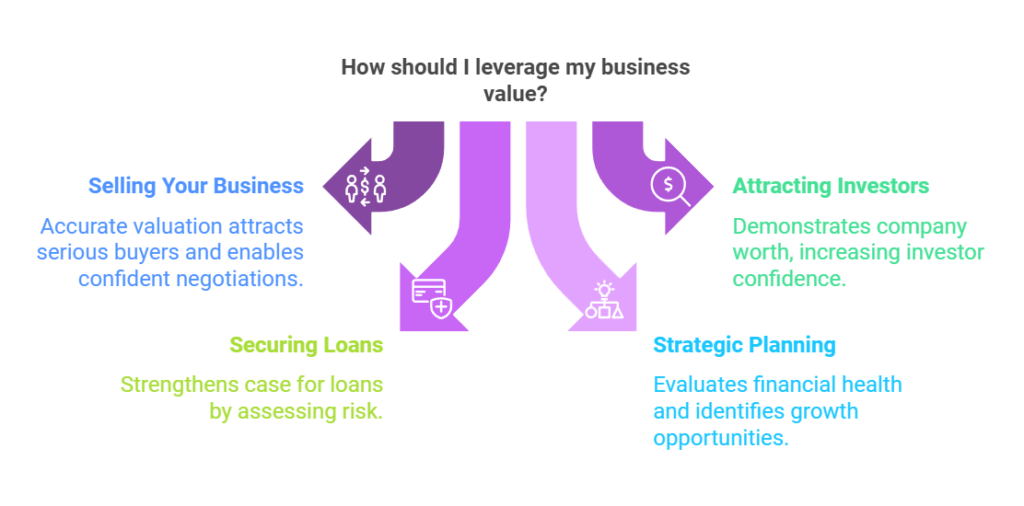

Key Concepts in Business Valuation

Seller’s Discretionary Earnings (SDE)

SDE represents the total financial benefit the owner receives from the business. It includes EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), the owner’s salary, discretionary expenses, and one-time costs. This metric is commonly used for small businesses.

EBITDA

EBITDA measures a business’s profitability before accounting for financial and tax obligations. Unlike SDE, it excludes owner-specific benefits and is often used for valuing larger businesses.

Intangible Assets

These are non-physical assets such as brand reputation, customer relationships, intellectual property, and trademarks. Intangibles can significantly influence a business’s value and should not be overlooked.

Fair Market Value (FMV) vs. Market Value (MV)

FMV is the theoretical price both buyer and seller would agree upon in neutral conditions. MV, on the other hand, reflects the actual price dictated by demand, urgency, and other market factors.

Multiples

Business valuation often involves applying a multiple to financial metrics like EBITDA or SDE. Multiples depend on industry norms, business stability, and market conditions. For small businesses, these typically range from 2 to 4, while larger companies may achieve higher multiples.

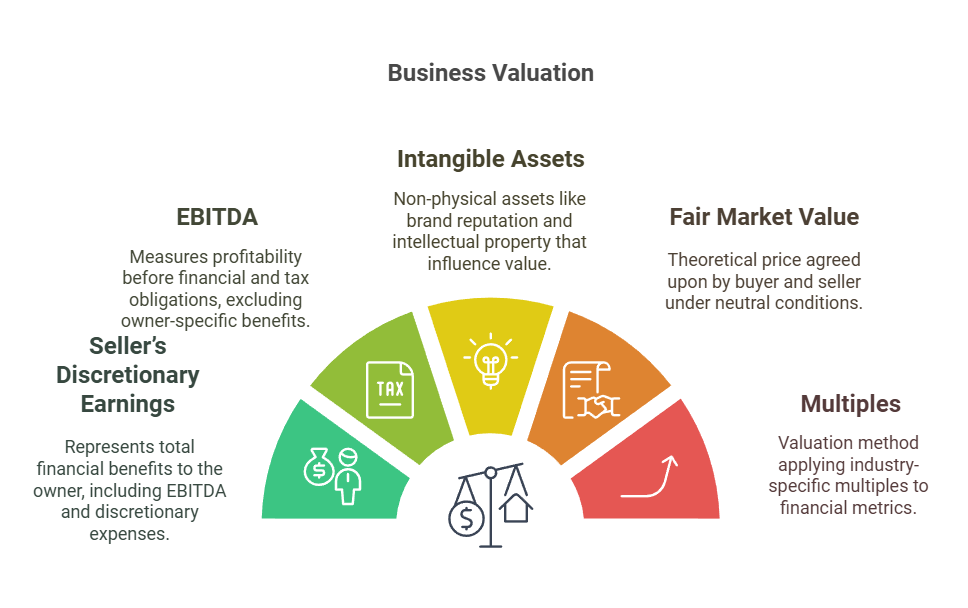

Methods for Calculating Business Valuation

Asset-Based Valuation

This method calculates the value of all assets minus liabilities. It’s suitable for asset-rich businesses but may not fully account for profitability or growth potential.

Income-Based Valuation

Focuses on future earnings, using:

- Discounted Cash Flow (DCF): Projects future cash flows and discounts them to present value. Ideal for stable, predictable cash flows.

- Capitalization of Earnings: Uses SDE or EBITDA to estimate value based on profitability.

Market-Based Valuation

Compares your business to similar entities. Market multiples based on revenue or earnings help estimate value, though this method requires robust industry data and can be subjective.

Seller’s Discretionary Earnings (SDE) Method

A popular approach for small businesses. Steps include:

- Calculate pre-tax, pre-interest earnings (EBITDA).

- Add back discretionary expenses and one-time costs.

- Apply an industry-specific multiplier (typically 1 to 4).

Entry Cost Valuation

Estimates the cost of building a similar business from scratch, considering assets, development, and customer acquisition.

Industry Rules of Thumb

Certain industries have specific valuation benchmarks. For example, real estate agencies may base value on the number of outlets, while IT firms might focus on annual turnover.

Step-by-Step Guide How to Price a Business for Sale

Step 1: Assess Profitability

Focus on net income, not gross revenue. Subtract all expenses to determine true profitability. Analyze profitability trends over several years for a more accurate assessment.

Step 2: Research Industry Multiples

Understand the typical multiples for your industry and adjust based on factors like market trends, business stability, and growth potential.

Step 3: Apply the SDE Method

Start with EBITDA, add back discretionary and one-time expenses, then multiply by an appropriate SDE multiple.

Step 4: Account for Intangibles

Consider factors such as brand reputation, customer loyalty, and intellectual property. These elements can significantly enhance your business’s value.

Step 5: Factor in Market Conditions

Evaluate how economic trends, interest rates, and industry dynamics influence your valuation.

Beyond the Numbers: Factors Affecting Business Value

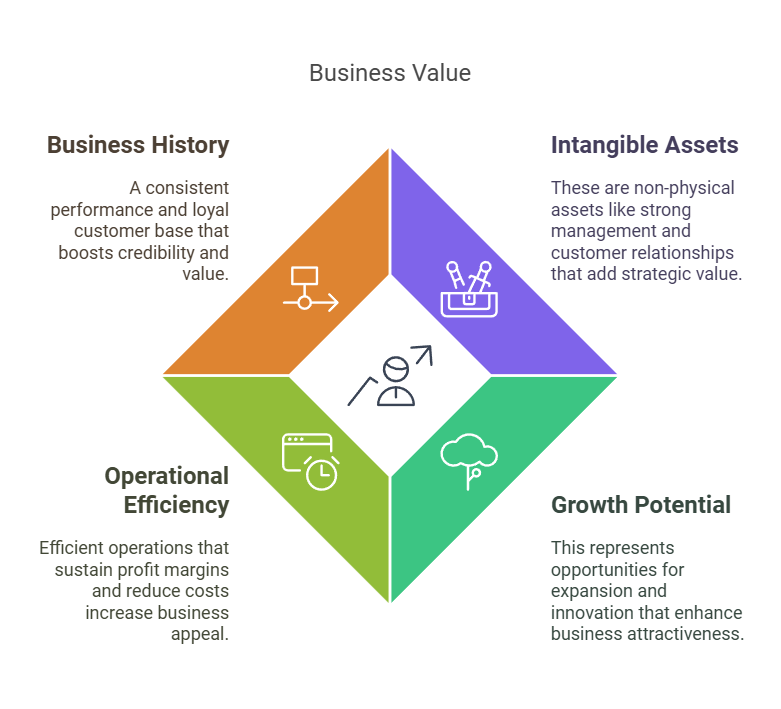

Intangible Assets

From strong management to customer relationships, intangibles add strategic value to a business. Identify and highlight these assets during the valuation process.

Growth Potential

Demonstrate opportunities for expansion, innovation, and market penetration. Growth potential directly impacts a buyer’s willingness to pay.

Operational Efficiency

Efficient operations that sustain profit margins and reduce costs increase attractiveness to buyers and investors.

Business History

A track record of consistent performance, loyal customers, and reliable cash flow boosts credibility and value.

Valuing a Business in Uncertain Markets

Agility and Revenue Diversification

Flexible businesses with varied income streams are more resilient in uncertain markets and thus more valuable.

Scenario Analysis

Assess past performance and potential future scenarios to provide a balanced valuation, especially during economic volatility.

Special Cases

Family-Owned Businesses

Consider emotional factors, legacy, and minority shareholder rights. Align valuation with both financial and non-financial priorities.

Seasonal Businesses

For seasonal businesses, average revenue over several years and manage cash flow fluctuations effectively.

When to Seek Professional Help

Benefits of Professional Valuation

- Unbiased Analysis: Experts provide an objective valuation.

- Hidden Value: Identify overlooked assets or intangibles.

- Negotiation Support: Ensure fair terms during the sale.

Pros and Cons of Self-Valuation

Pros: Cost savings, familiarity with the business.

Cons: Risk of inaccuracy, time-intensive, potential bias.

Tips for Maximizing Your Business Value

- Organize Financial Records: Maintain detailed financial documentation for at least three years.

- Enhance Profitability: Identify cost-saving measures and increase revenue.

- Build a Strong Team: A capable management team adds value.

- Protect Intangible Assets: Secure trademarks, patents, and contracts.

- Separate Business and Personal Finances: Clear financial boundaries improve bankability.

Negotiation and Closing

Negotiating the final sale price requires preparation and skill. While the appraised value provides a benchmark, the ultimate price depends on terms, timing, and buyer-seller dynamics. Focus on structuring a deal that benefits both parties.

Conclusion

Determining how to price a business for sale is both an art and a science. By understanding key valuation methods, accounting for intangibles, and staying informed about market trends, you can confidently assess your business’s worth. For complex scenarios, seek professional advice to ensure accuracy and fairness.

If you’re preparing to sell or evaluate your business, reach out to a valuation expert for personalized guidance. Remember, your business is worth what a buyer is willing to pay—and with the right preparation, you can achieve the best possible outcome.

Read next: LiteBlue: The Ultimate Guide to USPS Employee Portal